Getting The Opening An Offshore Bank Account To Work

Table of ContentsOpening An Offshore Bank Account Fundamentals ExplainedThe Main Principles Of Opening An Offshore Bank Account Getting The Opening An Offshore Bank Account To WorkLittle Known Questions About Opening An Offshore Bank Account.

The 9 largest banks and developing societies in the UK have agreed to supply basic checking account with no monthly costs to those who: no savings account; have a bank account somewhere else, however intend to alter supplier; have a bank account, but remain in monetary difficulty and desire their financial institution to open a new, useful represent them.If you reside in a country that belongs to the EU or European Economic Location (EEA), several banks will let you open up a bank account online without a UK address. This includes Lloyds Financial institution, which requests proof of ID and also EU address to be sent out by message (the original records, not copies, which will be retuned safely).

Others will carry out an ID look for both of you online. Here's an useful checklist of the details you could be asked to provide: You'll also be prompted to review the privacy plan as well as permission to your info being held by the financial institution or structure culture as well as shared with credit score referral companies.

You have a right to your transaction history for approximately 5 years after you have shut your account, thanks to regulations put in area by the Competition as well as Markets Authority (CMA). Switching over a savings account For the most part, it's a lot easier to switch to a brand-new supplier utilizing the Bank account Switch Solution (CASS) which aims to shut your old account and transfer all of your payment arrangements within seven working days.

Some Known Incorrect Statements About Opening An Offshore Bank Account

If you don't intend to close your old account, you can select a partial switch as opposed to a full switch. This is still an automatic process as well as must still be completed within 7 functioning days, however you aren't covered by the service assurance and deals won't be redirected. Checking account and probate: closing an account on death Once the fatality has actually been registered, the pc registry office will certainly release a death certificate this is called for by economic companies and federal government divisions to clear up the affairs of the deceased.

You can commonly shut an account without going via probate if the complete equilibrium is below a certain limit (see table listed below). If the complete funds exceed this threshold, the financial institution will certainly ask to see a certification called a 'give of probate', or 'letter of administration' in Scotland, to confirm that you deserve to manage their affairs.

They are straightforward without concealed fees and permit you to manage your cash either in branch, online, or over the telephone. To make an application for a present account at the Post Office you important source can see page your regional 'Crown' branch these are usually the major post office in a location. You'll need to be 18 or over, a UK homeowner as well as able to open your account with a 20 down payment.

3 Easy Facts About Opening An Offshore Bank Account Shown

Additionally see their internet site or call 0845Â 266Â 8977. Cooperative credit union are not-for-profit area organisations run by participants, for participants. If you live or operate in an area where a credit rating union operates you could be qualified to join. Some credit score unions offer bank accounts comparable to standard savings account.

As soon as you pick a financial institution and fill in some documents, you can entrust to a working account. Yet the procedure can obtain a bit much more complex because you typically have to give documents to verify your identity. It can obtain irritating and postpone your capability to use the account if you do not supply the ideal paperwork.

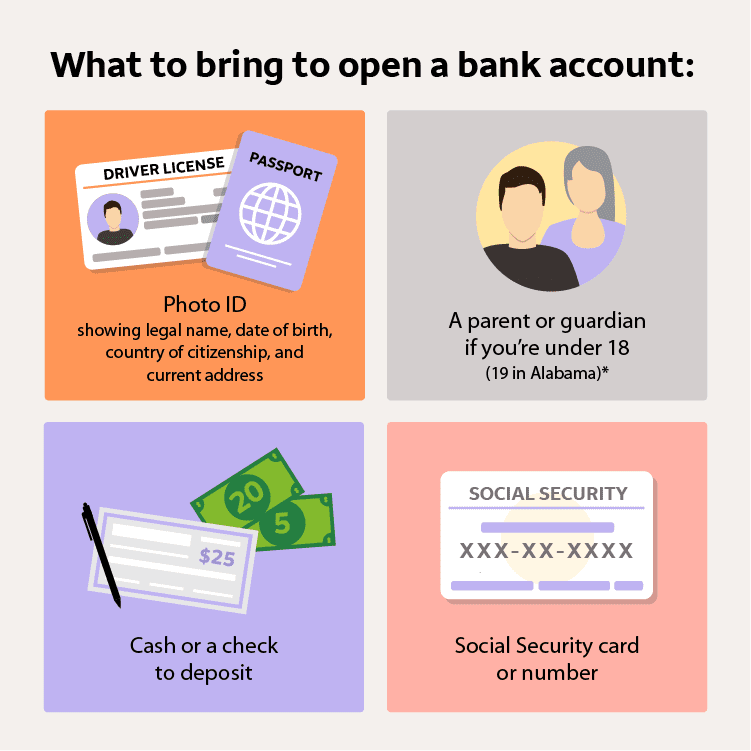

All financial institutions call for that account owners are at the very least 18 years old, although most enable a small to be noted as a joint account holder with a moms and dad or guardian. A bank might turn you down if you have actually criminal convictions connected to scams or financial crimes or if an additional financial institution shut your account due to mismanagement, such as overdue overdraft accounts. opening an offshore bank account.

While not all financial institutions call for every one of these records, it is much better to have them with you even if you don't need them. Government-Issued Identification Almost every financial institution needs you to present a valid government-issued picture Read More Here ID when opening a checking account. This confirms that you are that you claim you are as well as allows the bank to match your name to your face - opening an offshore bank account.

8 Easy Facts About Opening An Offshore Bank Account Explained

If you don't drive, head to your division of car (DMV) and also apply for a state-issued ID. Unlike a motorist's certificate, you don't require to pass a test to get one. Simply make certain you bring your birth certificate or valid passport and proof of address with you to the DMV.

If you do not have either, be certain to use for an ITIN prior to going to the financial institution to open your account. Keep in mind, it can take a number of weeks to get it.

While a few banks enable you to open a checking account utilizing a blog post workplace box, the majority of call for that you consist of a physical address on the account. The very best means to show your address is by generating an existing official paper with your name as well as address. Your newest utility bill, cable bill, charge card declaration, and even a mobile phone expense ought to be enough.

, the bank might additionally need evidence of enrollment at a qualified institution. Student accounts come with reduced or no charges and also may likewise have other rewards, such as discounted prices for credit cards as well as other financial obligations.